Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

Roth conversions have become very popular in the last decade. They can deliver big advantages, but also some big up-front expenses. Consider all the aspects to Roth conversion before making a decision.

Before we dive into the mechanics of a Roth conversion, let’s review the basics of Roth IRAs. The Roth IRA is an Individual Retirement Account. It is created by, and for, individuals. This distinguishes it from employer retirement plans, which allow large groups of people to participate.

The Roth IRA is named after former Sen. William Roth of Delaware and was first available in 1998. Characteristics of Roth IRAs include:

With a Roth IRA, you pay taxes upfront, generally on your income. Since your contributions have already been taxed, they are considered “after-tax contributions.” This distinguishes Roth from traditional IRAs; traditional IRA contributions are tax deductible, which makes them tax deferred.

The interplay of tax deductibility now versus tax-free distributions later is always one of the most critical decisions in retirement planning.

Roth conversions were uncommon before 2010 due to unfavorable tax restrictions. However, since 2010 the Roth conversion has been a popular financial strategy.

Conversion refers to the process of changing your IRA status from a traditional IRA to a Roth IRA. Conversion from traditional to Roth IRA has two immediate impacts:

Distributions from Roth accounts are tax free in the following circumstances:

You can convert all, or a portion of your traditional IRA to a Roth IRA. It is also possible to convert traditional 401(k) plan assets to Roth 401(k) dollars with the same outcome, if your retirement plan allows for this.

Roth IRA conversion is attractive for one main reason: tax-free investment growth and distributions. Since you’ve already paid tax on the money that went into the Roth IRA, your investment gains are not taxed when you withdraw them, assuming you follow the rules.

People consider Roth conversion when they believe that they will pay higher taxes in the future. This circumstance can come about when either, or both, of these are true:

You can’t control tax rates, and while many people have an opinion about future rates, there’s no way to know for sure what they’ll be even a year or two down the road.

While most people expect to need lower incomes in retirement, you need to keep in mind that distributions from traditional retirement accounts (traditional IRAs, 401(k) plans, pension income, etc.) are added to any income you receive during the year.

So, if you’re still working, but also receiving retirement income, your taxable income could be higher than before your retirement. This is especially true if your spouse is also working, or if you have rental or other passive income that rises over time.

While less likely, you should at least consider the possibility of extraordinary investment gains in your account. If this occurs in a non-Roth account, you’ll need to take required minimum distributions (RMDs) once you reach age 70½. If your account balances are large enough, the tax on your RMDs could exceed your current income taxes.

The disadvantages of conversion are the mirror image of the advantages. For one thing, you’ll need to pay taxes on the conversion amount. Depending on the size of your conversion, this can be a substantial amount: a $250,000 conversion for someone in the 22% tax bracket is $55,000.

It’s essential that you pay for the tax bill out of savings, or from some source other than your IRA. Otherwise, you’re taking a double hit: You’re sending $55,000 to Uncle Sam, and you’re also losing out on future investment gains on the money if you use it to pay your tax bill.

Another negative scenario would occur if you actually end up paying lower taxes in the future than you’re expecting. This would come about if you’re able to live on a smaller income, or if tax rates are similar to today’s, or lower.

If this lower income and/or lower tax scenario turns out, then you may well pay more in taxes during your Roth conversion than you will save in the future.

If Roth conversion appeals to you, there are a few guidelines that can optimize your decision making.

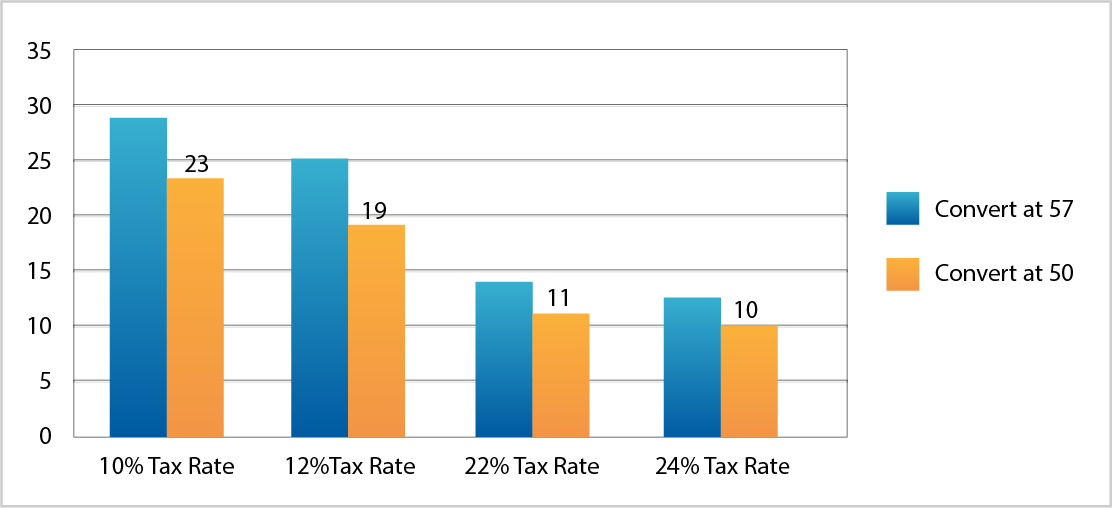

Assumes that funds after conversion compound at 3%, and that $2,000 is contributed each year until age 67.

The younger you are, the better.

As you can see from the chart, the time from conversion to retirement is a critical component in your conversion decision. The chart shows the number of years you need to receive tax-free income

in order to make up for the Roth conversion tax. A longer timeline allows you to make up for the cash you sent to the IRS, and grow even more tax-free dollars.

Your income is too high to contribute to a Roth.

If your income is too high to make Roth contributions , you can convert Traditional IRAs

or 401(k)s to Roth. This procedure is sometimes known as a “backdoor Roth” IRA.

Your investment account has suffered a decline.

Following through on a Roth conversion during a market correction can make very good sense. If you convert while your investments have declined in value, your taxable amount will

be minimized. Plus, if you hold onto those investments and they later increase in value, the gain won’t be taxable.

You know income taxes are increasing.

If you become certain that your taxes will increase, either because tax cuts are expiring, or because of legislation that’s under consideration, converting to Roth before the increase becomes

effective can save you money.

You should not convert a traditional IRA or 401(k) account to Roth if you cannot afford to pay the taxes. If you don’t have enough saved outside of your retirement account to pay the taxes, you should not perform a Roth conversion.

Roth conversion should be carried out in the context of your overall retirement and estate plan. If you think it’s good for you, speak with your advisor. Making conversion a part of your retirement plan will allow for optimal decision making and investment planning.

Alliance America is an insurance and financial services company. Our financial planners and retirement income certified professionals can assist you in maximizing your retirement resources and help you to achieve your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.